Press Release

|January 02,2026Brisk Home Sales Helped To Support Private Home Prices In Q4 2025, While HDB Resale Prices Were Flat On Weaker Resale Volume

Share this article:

02 January 2026, Singapore - Flash estimates showed that private residential property prices in Singapore continued to edge up in Q4 2025, helped by healthy home sales and the landed homes segment. Meanwhile, HDB resale flat prices - which have seen slower growth through much of 2025 - were flat in Q4 2025 amid softer resale volumes. It is the first time that HDB resale prices were unchanged in nearly six years, since Q1 2020. The final real estate statistics for Q4 2025 will be released on 23 January 2026.

Q4 2025 URA Private Residential Property Index (Flash)

Prices of private homes inched up by 0.7% QOQ in Q4 2025, following the 0.9% QOQ increase in the previous quarter(see Table 1), based on the flash estimates. The price growth in Q4 2025 was mainly driven by the landed housing segment. This is the fifth consecutive quarter of price increase and private home prices have posted a cumulative growth of 3.4% in 2025 - a shade lower than the 3.9% increase in 2024.

Table 1: URA Private Property Price Index (PPI)

Price Indices | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 Flash |

(QOQ % Change) | (YOY % Change) | (QOQ % Change) | |||||||

Overall PPI | 1.4 | 0.9 | -0.7 | 2.3 | 3.9 | 0.8 | 1.0 | 0.9 | 0.7 |

Landed | 2.6 | 1.9 | -3.4 | -0.1 | 0.9 | 0.4 | 2.2 | 1.4 | 3.5 |

Non-Landed | 1.0 | 0.6 | 0.1 | 3.0 | 4.7 | 1.0 | 0.7 | 0.8 | -0.1 |

CCR | 3.4 | -0.3 | -1.1 | 2.6 | 4.5 | 0.8 | 3.0 | 1.7 | -3.2 |

RCR | 0.3 | 1.6 | 0.8 | 3.0 | 5.8 | 1.7 | -1.1 | 0.3 | 0.7 |

OCR | 0.2 | 0.2 | 0.0 | 3.3 | 3.7 | 0.3 | 1.1 | 0.8 | 1.0 |

In Q4 2025, the landed homes segment led price increase, with a 3.5% QOQ price growth - its strongest quarterly growth in two years. This is despite fewer transactions done in the quarter at 491 deals compared with the 559 landed homes sold in Q3 2025, according to caveats lodged. Landed home prices found renewed strength since Q2 2025, and have risen by 7.7% cumulatively in 2025 which is significantly higher than the 0.9% increase in 2024 - as lower interest rates likely boosted sentiment.

Over in the non-landed private homes segment, prices dipped by 0.1% QOQ in Q4 2025, reversing the 0.8% QOQ increase in the previous quarter. This is the first decline in non-landed private home prices since Q2 2023. Within the non-landed homes market, the Outside Central Region (OCR) saw the largest price increase in Q4 2025 at 1.0% QOQ, taking the cumulative price growth in 2025 to 3.2% in the sub-market - slowing from the 3.7% growth in 2024. There was just one mass-market new launch during the quarter, namely Faber Residence which has sold around 91% of its 399 units (at an average price of $2,155 psf) since the project was launched in October, according to URA Realis caveat data.

This is followed by the Rest of Central Region (RCR) where non-landed home prices notched a 0.7% QOQ increase in Q4 2025, leading to a cumulative price gain of 1.6% in 2025 - substantially lower than the 5.8% growth in 2024. The price growth in Q4 came on the back of healthy take-up of units at new launches, such as Penrith and Zyon Grand. As at 21 December 2025, Penrith sold 448 of its 462 units at an average price of $2,804 psf, while caveat data showed that Zyon Grand shifted 608 of its 706 units at an average price of $3,053 psf in Q4 2025 (see Table 2). The Sen sold 22% of its units at an average price of $2,357 psf.

Meanwhile, prices in the Core Central Region (CCR) snapped a 4-quarter growth streak, falling by 3.2% QOQ in Q4 2025, overturning the 1.7% QOQ growth in the previous quarter. The decline in Q4 may be partly due to a larger number of new units being sold at higher average prices in Q3 2025. Cumulatively, non-landed home prices in the CCR have risen by 2.2% in 2025, easing from the 4.5% increase in 2024. The CCR new launch in Q4 was Skye at Holland which has transacted 99% of its 666 units at an average price of $2,954 psf since its launch in October, based on caveats lodged (till 21 December).

Table 2: New launches in Q4 2025

Project | Region | Units sold* | Total units | Take-up % | Average unit price ($PSF)* |

SKYE AT HOLLAND | CCR | 662 | 666 | 99.4% | $2,954 |

PENRITH | RCR | 448 | 462 | 97.0% | $2,804 |

FABER RESIDENCE | OCR | 361 | 399 | 90.5% | $2,155 |

ZYON GRAND | RCR | 608 | 706 | 86.1% | $3,053 |

THE SEN | RCR | 77 | 347 | 22.2% | $2,357 |

Total | 2,156 | 2,580 | 83.6% | - | |

Transactions in Q4 2025 and full-year 2025

New private home sales came in at an estimated 2,882 units (ex. EC) in Q4 2025 and transactions surged to a four-year high in 2025, with developers selling a total of 10,757 units (till 21 December) - up by 66.3% from the 6,469 new units (ex. EC) that changed hands in the whole of 2024. In 2025, the RCR led developers' sales with 4,448 units sold, followed by the OCR and CCR with 4,404 and 1,905 units transacted, respectively. Of note, all sub-markets posted four-year high new home sales in 2025, since 5,433 RCR new homes, 5,073 OCR units, and 2,521 CCR units were transacted in 2021.

In the private residential resale market, an estimated 2,954 units were resold in Q4 2025, taking the overall resale volume to 14,047 units in the year (till 23 December). This is relatively comparable to the 14,053 resale units that were transacted in 2024. In particular, there were 2,592 units resold in the CCR, the highest resale tally in this sub-market in four years - likely supported by the confidence boost from the strong rebound in CCR developers' sales and new launches bringing more attention to prime districts and nearby resale stock.

Over in the EC segment, developers sold 73 new units in Q4 2025 (till 21 December), pushing sales to an estimated 1,623 new EC units in 2025 - a four-year high since 2,119 EC units were transacted in 2021. Sales of new EC units are expected to rebound in Q1 2026 with two new projects (Coastal Cabana and Rivelle Tampines) slated to be launched.

Mr Kelvin Fong, CEO of PropNex said:

"In our view, the price growth in the private housing segment in Q4 2025 was measured, contributing to a year of more sustainable price increase, despite new home sales hitting a four-year high and the relatively stable demand in the resale market. Based on the flash estimates, overall private home prices grew by a cumulative 3.4% in 2025 - the slowest pace of growth since 2020. The moderate price growth is a welcome development for the market, as a calmer pricing environment can help to reduce FOMO (fear of missing out) and hype, leading to steadier demand.

While all sub-markets saw strong sales in 2025, we single out the resurgence in the CCR as a top highlight. That the CCR demand returned in a meaningful way - with healthy participation from local buyers - suggests a more balanced property market, healthy domestic liquidity among homebuyers, and stronger buyer confidence. Based on caveats lodged, Singaporean buyers accounted for 82.6% of non-landed new private home sales in the CCR in 2025 (till 21 December) - the highest proportion on record since 1995.

Overall, Singapore's private residential property market has demonstrated resilience and saw renewed buying interest in 2025, underpinned by healthy demand in both the primary and secondary markets. One of the key drivers has been the sharp moderation in interest rates - the 3 Month Compounded SORA (Singapore Overnight Rate Average), which banks use to price home loan packages fell from 3.02% p.a. in the beginning of 2025 to around 1.19% p.a. as at 31 December 2025.

With borrowing costs having eased from previous highs, some buyers who had been on the sidelines have moved decisively on a property purchase. A more accommodative interest rate environment provides an impetus for buyers to lock in purchases while financing remains favourable and before home prices potentially inch up, seeing that land prices have been on the uptrend recently. It also helped that there was an ample slate of new launches, many of them well-located and developers have generally priced units competitively.

All in all, we think 2025 has laid the groundwork for a resilient private housing market in 2026, one that is supported by more stable interest rates, low unemployment, healthy household balance sheets, and a stream of attractive upcoming launches. In 2026, we anticipate that some 20 projects (ex. EC) with around 8,487 units, and possibly four EC projects which offer 2,040 new EC units may be launched - taking the total launch pipeline supply to 10,527 units, which is slightly lower than the 12,860 total units launched in 2025 (comprising 11,500 private homes and 1,360 EC units).

PropNex projects that developers' sales may range from 8,000 to 9,000 units (ex. EC) in 2026 in view of the tighter launch pipeline, while private resale home volume may come in at about 14,000 to 15,000 units. Meanwhile, we expect private home prices could continue to grow moderately at 3% to 4% in 2026."

Q4 2025 HDB Resale Price Index (Flash)

Flash estimates from the Housing and Development Board (HDB) showed that resale flat prices were flat in Q4 2025, following a trim 0.4% growth in Q3 2025 (see Table 3). This is the first time that HDB resale prices were unchanged since Q1 2020. Overall, HDB resale prices rose by a cumulative 2.9% in 2025 - the most sluggish pace of price increase in this housing segment since 2019 where prices inched up by 0.1%.

The HDB said there were 5,129 flats resold in Q4 2025 (till 30 December 2025). The resale volume is set to underperform the 7,221 units transacted in Q3 2025, as well as the 6,424 resale flats sold in Q4 2024. Taken together, some 26,042 public housing flats were resold in 2025 (till 30 December) - lower than the 28,986 resale flats transacted in 2024.

Table 3: HDB Resale Price Index

Quarter | QOQ % change | YOY % change |

Q1 2022 | 2.4% | 12.2% |

Q2 2022 | 2.8% | 12.0% |

Q3 2022 | 2.6% | 11.6% |

Q4 2022 | 2.3% | 10.4% |

Q1 2023 | 1.0% | 8.8% |

Q2 2023 | 1.5% | 7.5% |

Q3 2023 | 1.3% | 6.2% |

Q4 2023 | 1.1% | 4.9% |

Q1 2024 | 1.8% | 5.8% |

Q2 2024 | 2.3% | 6.6% |

Q3 2024 | 2.7% | 8.1% |

Q4 2024 | 2.6% | 9.7% |

Q1 2025 | 1.6% | 9.4% |

Q2 2025 | 0.9% | 8.0% |

Q3 2025 | 0.4% | 5.6% |

Q4 2025 (Flash) | 0.0% | 2.9% |

Ms Wong Siew Ying, Head of Research and Content, PropNex Realty said:

"After various demand- and supply-side measures, it appears that the HDB resale market has achieved a soft landing, with prices rising at a slower, more sustainable pace in 2025. HDB resale prices were flat in Q4 2025, following four straight quarters of weaker growth.

Additionally, the HDB resale volume has also softened substantially in Q4 2025 - likely recording the weakest quarterly sales since 3,426 flats were resold in Q2 2020, when the pandemic-related restrictions (circuit breaker) disrupted market activity. The slower sales in Q4 2025 may be attributed to the steady supply of new flats drawing some buyers away, the seasonal year-end slowdown in transactions, rising price resistance among prospective buyers, and the moderation in HDB resale prices of late potentially reducing the urgency to act among homebuyers.

We believe the more subdued price movement and stabilsation in the HDB resale market helps to maintain affordability for homebuyers, and generally support confidence in the resale flat market. To this end, the moderation in price growth in 2025 is positive for the overall market, and perhaps may reduce the likelihood of further cooling measures on the HDB resale segment - policy stability, in turn will enable buyers and sellers to act with greater clarity.

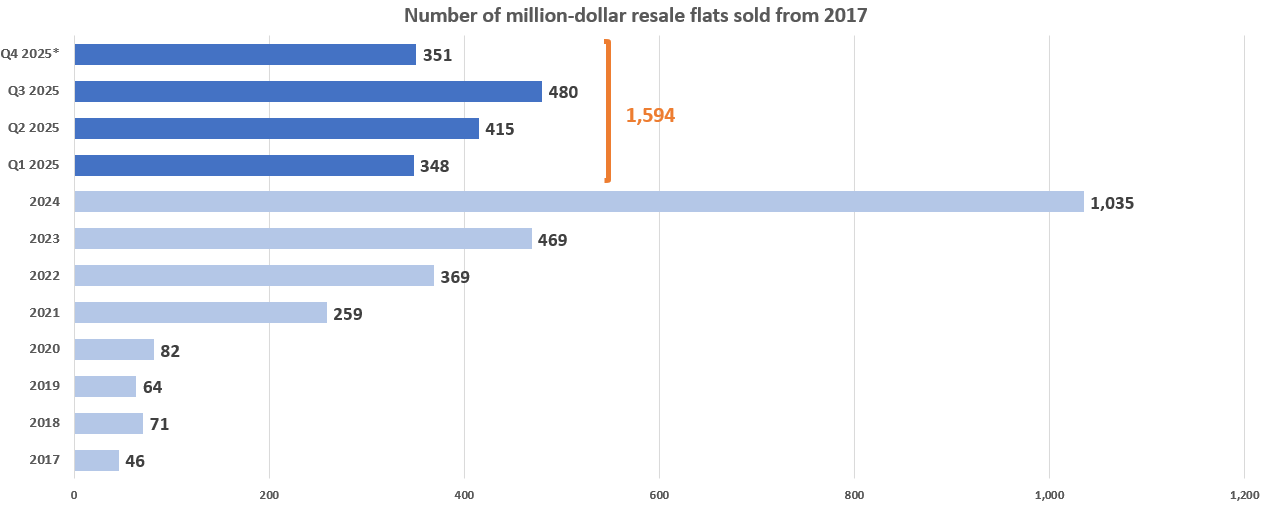

Chart 1: Number of million-dollar resale flats sold

That said, certain segments are still seeing strong demand which has underpinned the sale of the so-called million-dollar resale flats, where units are resold for at least $1 million. There were 351 such flats sold in Q4 2025, taking the total to 1,594 units of million-dollar resale flats transacted in 2025 (data retrieved on 2 January 2026) - surging beyond the record 1,035 such units resold in the entire 2024 (see Chart 1).

Based on transaction data, the 1,594 units of million-dollar resale flats comprised two 3-room terrace flats, 664 units of 4-room flats, 557 units of 5-room flats, 368 executive flats, and three multi-generation flats. About 8.7% (or 139 units) of the million-dollar flats are located in non-mature towns, with the remaining 1,455 units in mature estates, led by Toa Payoh with 302 transactions, followed by Bukit Merah and Queenstown where 216 and 173 such units were sold, respectively.

In 2026, we project that HDB resale transactions may range from 26,000 to 27,000 units, supported by a greater number of new flats reaching the 5-year minimum occupation period (MOP) making them eligible to be resold. It is projected that there may be 13,500 MOP flats in 2026 - up by nearly 69% from the 8,000 units in 2025. Meanwhile, we expect HDB resale prices could rise by 3% to 4% in 2026, continuing the trend of increased stability and moderate price growth."